How Tesla is BANKRUPTING its ‘competition’ and the BIGGEST RISKS for Tesla Stock to skyrocket.

Game Over Tesla has won…. How Tesla has the most profitable cars EVER and how Tesla can battle inflation and rising costs to stay as the number one Electric Vehicle company and more in this article!

There is no real competition.

Instead, Tesla is Bankrupting their competition.

Tesla has positioned themselves to survive these difficult times, as high inflation and chip shortages force other car manufacturers to LITERALLY STOP production. Thanks to Tesla making the MOST PROFITABLE vehicles Tesla will be able to survive and thrive.

So what the hell is going on? What will happen to Tesla stock during these difficult times and how has Tesla created THE MOST PROFITABLE vehicles on the market?

In this article I talk about the BIGGEST RISKS facing Tesla at the moment whilst also discussing specifically how Tesla is bankrupting their competition and is on pace to become one of the worlds biggest companies ever…..

Why the Competition is Dying 🤯

Thankyou for opening your Tesla folder! 📂

In the last week alone, due to oil prices rising to record levels, the number of people ordering Tesla’s grew by 100%! Soaring gas prices really show the power of Electric Vehicles and people are realizing that Tesla makes the best. Buying a Tesla in the long run literally saves you hundreds of dollars of fuel and repair costs.

Meanwhile the ‘competition’ is literally shipping vehicles without key security features, like Ford shipping vehicles without chips controlling non-safety critical features. Not only this, but Ford and other OEM’s are at the mercy of dealerships, Tesla doesn’t have this ridiculously outdated model and is achieving higher profit because of it. You know something else that competitors can’t say?

You know something else that competitors can’t say? The fact that a Tesla will be harder to order and buy TOMORROW than it is today! The Tesla backlog is growing, I’ve said it time and time again, Tesla has a supply issue, not a demand issue.

The Tesla back log (number of vehicles ordered but not yet delivered) is growing rapidly, with the average Tesla buyer waiting (eagerly) for 3.5 months before they can drive their new car.

This backlog is actually GROWING, this is despite Tesla increasing production and increasing their prices. This is a super bullish indicator….

Why would anyone want a non-Tesla EV? Or even a non Tesla vehicle in general?

“If (you) care about having the latest technology, much lower cost of ownership than an ICE vehicle, little maintenance and best in class safety, then an EV is the way to go (specifically a Tesla). “ Respected Twitter analyst Sawyer Merritt said

And that isn’t even taking into account that Tesla’s tend to APPRECIATE after having bought them..

“Tesla’s hold their value better than almost any major auto makers vehicles.” said Merrit.

OK, so buying a Tesla and having the cars value go up is insane right. But it gets crazier.

Let me tell you something REALLY crazy.

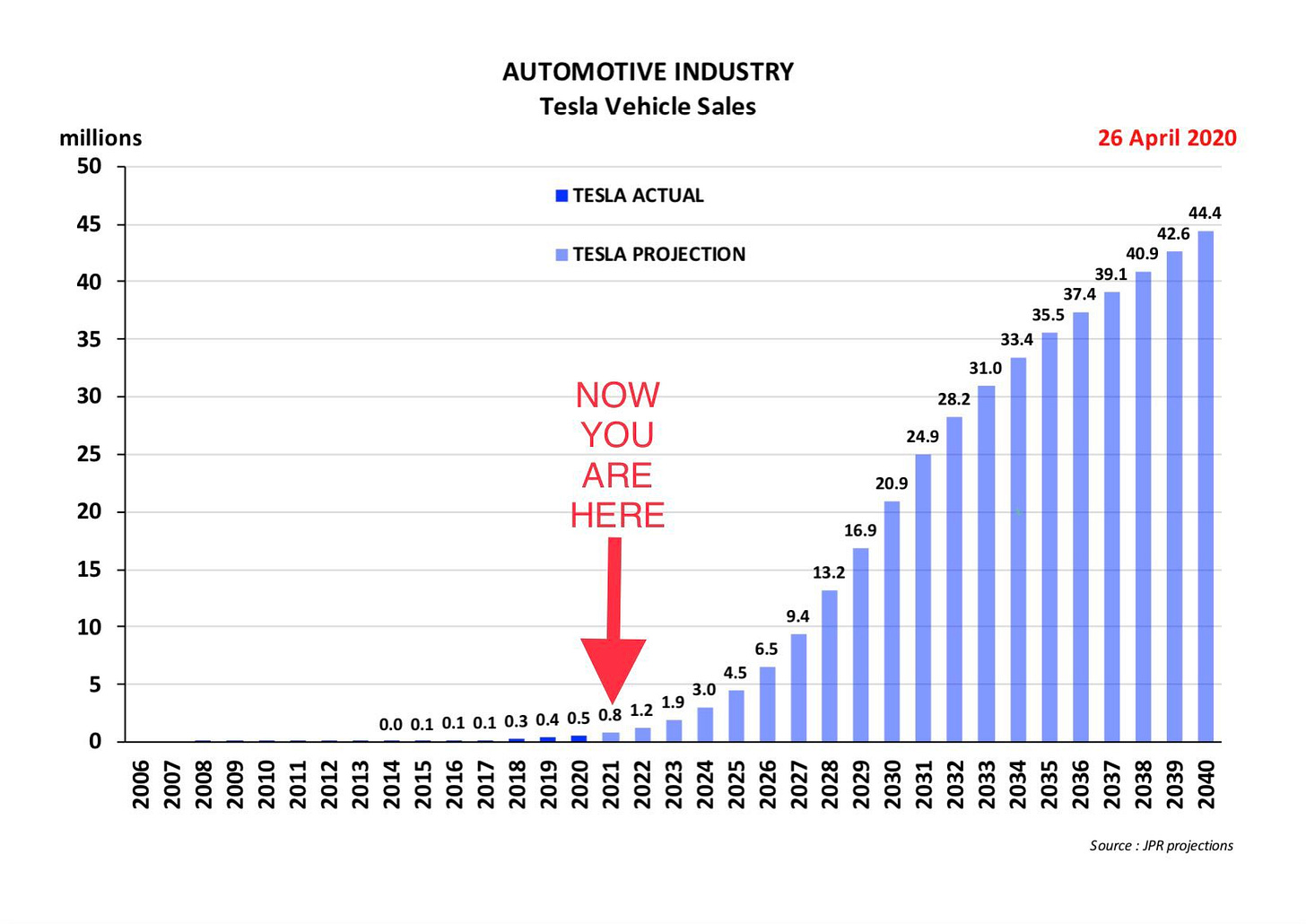

Tesla delivered 500k cars in 2020 and nearly doubled that IN ONE YEAR to 930k deliveries in 2021 WITHOUT ADDING ANY NEW FACTORIES…..

And you know what is even crazier??! Tesla is about to OPEN TWO! YES TWO NEW FACTORIES!

In these factories Tesla will implement all the things they’ve learned from the Shanghai and California factories to ensure that the Berlin and Texas facilities will be producing 500,000+ vehicles per year! Specifically Giga-Berlin will start production on March 20th!!! This is absolutely groundbreaking for Tesla in Europe. Respected Tesla investor Sawyer Merritt outlined it perfectly when he said:

“Tesla is already a leader in sales in Europe and sales will only continue to grow with the opening of Giga Berlin.”

The current issues in Europe have mainly been the fact that Tesla is importing all of the currently sold European EV’s. The costs associated with this mean Tesla makes significantly less profit on Tesla’s sold in Europe than those in China or in the United States. However with the opening of Giga Berlin this will change very soon.

“Tesla has been supply constrained in the EU for a long time, so the opening of Giga Berlin is a massive deal. Sales will skyrocket. “ Merrit said

When asked what major shocks Tesla could survive that competitors would struggle with, Merrit said:

“Tesla is the most vertically integrated major automaker in the world. This allows lower prices, agile manufacturing, quick process change and adaptability not possible with traditional OEM structure”

He again mentions something super interesting, and something that many people surprisingly don’t know, and that is the fact that no other car manufacturer has the level of Vertical Integration that Tesla has.

This has allowed them to scale so massively whilst competitors struggle to produce meaningful amounts of EV’s.

Merrit further said that “Tesla has handled the chip shortage better than most OEMs because of their vertical integration and finding creative solutions. Tesla designs their own FSD chip in house. “

Meanwhile competitors are partnering with Sony and other brands to produce the software for their vehicles, this is simply not good enough. Further stating that

“Nobody in the auto industry has done anything remotely similar.”

It is clear that in this business Tesla is clearly number 1 and approaching the finish line, whilst competitors are just starting the race..

However, as Rocky Balboa once said “the world aint all sunshine and rainbows“ And even Tesla has some SERIOUS SERIOUS risks they are battling and need to overcome quickly……

The Biggest Risks for Tesla right now⚠

The world, not just Tesla is navigating a tough road right now. It is misty, and it is hard to see what is in front of us. Nevertheless we must navigate and get to our destination safely and quickly.

IF the world doesn’t transition to sustainable energy soon it may be too late. Companies all around the world are facing serious inflationary risks, Tesla is no exception.

The stock is down more than 30% from it’s all time highs. Here are the biggest risks facing the company at the moment.

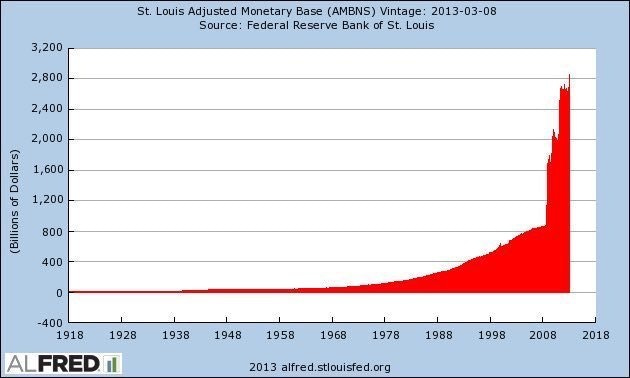

Inflation hasn’t been this bad in a long time, during the 2020 pandemic roughly 80% of all currency in circulation was printed. This is a huge risk!

This is a huge risk, and with COVID lockdowns still creating supply chain bottlenecks and natural resources getting more and more expensive, this inflationary pressure is likely to last for a while.

This is important for Tesla because material prices skyrocketing is dangerous as Tesla relies heavy on certain materials to produce their vehicles. What we are seeing in recent days with Tesla increasing the price of its products is a direct response to the inflation they are seeing in their supply chain. You can see the increase in prices here:

Luckily Tesla has a nice cushion and can absorb higher cost of resources, but we see they are passing this on to consumers which means the increased cost of production is likely significant.

“(However) as Dan Ives of Wedbush said, ‘ Tesla has the ability to pass that [inflation] on to the consumer, very similar to Netflix & Amazon Prime. Demand for Tesla’s is high, and people are willing to pay for them.’ Said Merrit.

This is exactly what we are seeing, Tesla is uniquely positioned to navigate the current inflation storm, Tesla is much better prepared than its competition.

“(Tesla) Wait times are still as long as ever. Margins will likely start to dip next quarter anyway due to Tesla opening up Giga-Texas and Giga-Berlin and ramping those factories up (Which require lots of capital)” Merrit said.

Similarly another risk, something that has been worrisome for some time now is Key man risk. It is the risk that if a critical employee is out for any extended period of time and for any reason, that it could seriously hurt your business.

It’s obvious for Tesla who i’m talking about. I’m talking about Elon Musk. He has been integral to Tesla’s success, we need him to stay onboard as CEO for the near future as Tesla continues their rapid growth.

This third risk is the reason Tesla stock actually DROPPED after record earnings. The fact that Tesla spent so much time talking about FSD and Robotaxis without addressing institutional investor concerns regarding the product roadmap update (Cybertruck, Tesla-Semi) and other factory related questions. However it is hard…

It is hard to give Tesla a lot of credit for a future (potential) success, investors want to see results about things they understand. FSD is something they don’t.

“Solving full-self driving is tough (clearly), but I believe Tesla will achieve it.” Merrit Said

That being said, FSD is continually improving and it is onlya question of WHEN not IF it becomes good enough where humans are no longer needed.

Another major risk Sawyer Merritt sees is the scaling of the 4680 batteries, a new technology that will prove hugely important for future Tesla growth.

“Scaling 4680 is another risk. We don’t yet know if they can do it and things have taken longer than expected.

Tesla has some of the best engineers and minds in the world though working for them so I have no doubt they will succeed on that front too. Tesla said they produced 1 million 4680 cells as of January 2022.”

Lastly, one of the biggest risks facing Tesla at the moment is actually a big one, namley: Geopolitical risk.

With everything happening in Ukraine, we need to remind ourselves that China isn’t a democracy. Although due to China being so integrated with the Western economies, and being a more mature company than Russia, i don’t expect China to bully Tesla around but it is always a risk one must consider. That being said, China is one of the worlds largest (car) markets and it is absolutely crucial Tesla has good relations with China and holds a factory there.

With all of this being said. You need to relax. You need to stop. You need to take a step back. Make sure that you’re not panic trading and losing money, either by selling or buying something you do not understand.

For Tesla bulls it is simple. Has Tesla lost demand? No. Are Electric Vehicles no longer the future? No. Is Tesla software/tech getting worse? No. Is Elon leaving anytime soon? No. Is the business shrinking? No.

Keep a long term focus, keep your cool during these turbulent times. Tesla makes the MOST PROFITABLE vehicles in the world, how? Only a few years ago Tesla was losing money?! Let me tell you EXACTLY how, it’s actually crazy!…….

How Tesla makes Most Profitable cars📈

Tesla will become one of the worlds most profitable companies this decade. Think about how powerful that sentence is! As of Q4 2021 the Average Cost To Produce A Tesla Is Just $36,000!

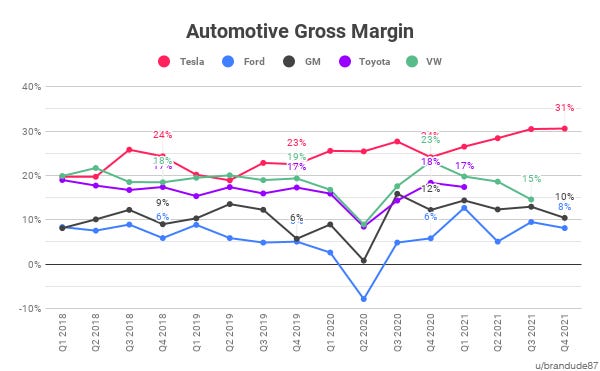

In Tesla's annual report, it noted that it achieved the highest operating margin "across all volume OEMs", that is insane!

It’s very interesting that the old argument against Electric Vehicles was ‘every EV sold is sold at a loss’ has never been further from the truth than today.

What is really going on is that Tesla is selling literally everything they make due to the high demand. This is thanks to Tesla’s innovative vertical integration.

Tesla is the most vertically integrated car manufacturer in the world, then you add the fact that Tesla doesn’t have a dealership model, Tesla is in control of a major share of its supply chain. Allowing for optimisation, lower cost of production and increased scaling. It is a key reason that Tesla was able to nearly double production from 500k vehicles to 930k vehicles in one year.

This graph is truly powerful and highlights just the immense differences between Tesla and their competition. This is also why Tesla is best positioned to face the current uncertain environment.

What people don’t realise is that Tesla is something completely new. It is very comparable to the Iphone. When first introduced people thought it was ridiculous to pay $500usd for a phone. But the value proposition was just so much bigger than any competing phone product it made sense.

The fact that Tesla has near 30% Gross Margins is simply not heard of. Each dollar Tesla saves compared to its competition is compounded exponentially because Tesla is able to re-invest into their company. This is producing state-of-the art Giga factories in Berlin and Texas, further growing the gap between Tesla and the competition.

As the competition starts building their own EV’s the gross margins for these legacy makers will continue to decline as they push EV’s. They wont be able to scale as efficiently as Tesla.

dropping during the early stages of their EV push because EV's is a loss-leader until you manage to scale efficiently. Let's call it the 'transition cost' that people generally don't account for. When talking about Tesla and how other automakers cannot catch up it is because Tesla has been making electric vehicles for more than a decade! Meanwhile the competition is only just starting….

So how is Tesla going to battle the risks they are facing? How is Tesla going to secure their position as the number 1 car brand? Let me tell you EXACTLY HOW this information ties to Tesla stock and your stock portfolio…..

What about the Tesla Stock Price? 💸

Historically, right now Tesla stock is super cheap. Since the start of the year Tesla price targets have gone up 17% from institutional investors.

These price targets are likely to continue to move higher as Giga Berlin opens and Giga Texas open, meanwhile Tesla will have another record quarter for Q1 2022. This disconnect between Tesla stock price and Tesla price targets and estimates is unprecedented.

As Future Fund manager Gary Black mentioned:

“This (is an) anomaly - higher estimates, lower Tesla price - won’t persist.”

It’s only a matter of time, currently the macro-environment is dominating Tesla stock price.

So What needs to happen for Tesla stock to catch up?

The War in Ukraine needs to end, the world and the people of Ukraine deserve better. This should help commodity prices come down as instability comes back down. Similarly inflation needs to stabilize and Tesla needs to prove that it can financially mitigate the higher cost of production whilst maintaining super growth. (The recent price increases show Tesla is being pro-active, it’s a good sign).

Inflation costs cannot keep increasing at the current rates, this instability can lead to long term risks for the entire economy including Tesla. The higher oil prices make EVERYTHING more expensive and could lead to economic down turn which in turn hurts Tesla.

What the current issues in Ukraine, and the dependency on the earth-killing Oil is showing, is that the future is undoubtedly, a necessity and the future of our planet IS ELECTRIC. These turbulent times have seriously proven how quickly we need to get off oil and gas and transition to sustainable energy and electric vehicles. This is good for Tesla.

Also remind yourself, the Tesla demand is growing, Tesla is about to open 2 new factories, Tesla creates the most profitable vehicles. Tesla is well positioned to mitigate the incredibly hostile macro-economic environment. In the long run, Tesla will continue to execute and strive towards the mission of sustaining the world to renewable energy.

Why You should want Tesla to win ⚡

Lastly I want to outline a few reasons why I and many people who follow me are not just financially hopeful for Tesla (they are continuing to show they’re super profitable and a great investment), but also because Tesla is truly changing the world for the better.

Tesla executing on their mission will lead to a cleaner, healthier and better Earth 🌍

Tesla and growing presence of EV’s is reducing our reliance on the disgusting resource called oil. ⛽

Tesla is helping the world decrease the number of road accidents, imagine a world where you don’t need to drive. Think about the number of lives saved and the productivity increased if FSD is approved! 🤖

Tesla is a revolutionary company, and i’m eager to continue to follow its progress.

I will continue to write in-depth Tesla articles, and keep you updated on the latest Tesla news to ensure you’re just as well informed, but without all the hours of research required!

TLDR Key-Take-Aways

🤯 Tesla‘s competition is being BANKRUPT

⚠The BIGGEST RISKS Tesla is facing

📈 How Tesla is making the MOST PROFITABLE vehicles

💸 Tesla stock is facing SERIOUS PRESSURE in the short term

You made it this far ? Wow, hey I guess follow me on Twitter here if you want :)