Tesla Catalysts January 2022

4 Major Catalysts that will affect the stock in the next 30 days....

Despite Tesla stock being up over 55% year to date, Tesla is in a perfect position for another breakout month. There are 4 major catalysts that I will explain in this article that will have a major impact on the stock.

So why will Tesla be worth more at the end of January than it is now? Let’s find out.

1. Q4 Deliveries beat by 30,000 vehicles

The consensus on wall street is that Tesla will deliver anywhere around 266k vehicles this quarter. This is about 30k lower than what it will be.

Twitter analyst Troyteslike has a very good track record of Delivery estimates and is predicting 287k vehicles, so Wall street is significantly off here. Troy-teslike has the following track record: Error Rate: • Q4 2020: +1.7% • Q1 2021: -10.7% • Q2 2021: -2.6% • Q3 2021: -2.6%, so we can be confident that his estimate of 287k vehicles isn’t far off what it will actually be.

There have also been many eye-witness reports that at nearly every single Tesla factories including the photo you see below of the Fremont factory, people have been reporting that there is a lot of activity happening and that the parking lots are fully crowded. So I am confident that Tesla deliveries will be over 900,000 this year.

Can we also appreciate how insane it is that in one quarter tesla will now produce over 250k vehicles whilst in 2020 tesla delivered only 500k vehicles the entire year! What Tesla is experiencing now is exponential growth, and that is not even mentioning the fact that Tesla is about to grow capacity by 50-60% with the second catalyst….

2. Giga Berlin & Giga Texas Open

These two new factories are set to open early in January. In Austin it is rumoured that they will be starting production with the 4680 batteries which is very exciting as these are significantly better performing than the currently used cells.

The Austin Texas Gigafactory is also expected to be where the Cybertruck will be manufactured which will likely launch at the end of the 2022 financial year. Whilst in Berlin, the simple fact that Tesla is producing vehicles on the European continent instead of shipping them from Shanghai will significantly reduce costs allowing for each car that is sold in Europe to have significantly higher profit margins than before. So these two new factories are huge catalysts which will provide significant output, with Giga Berlin expected to reach a peak of 700k cars per year at the end of Phase 1 whilst Giga Austin will likely produce around 500k vehicles per year. This is going to prove immense growth, and is one of the reasons WedBush has increased their price target.

2022 could be a golden year for Tesla, says Wedbush’s Dan Ives

“We’ve always viewed Tesla not as an auto company but as a disruptive technology company, our Base case is $1,400, the bull case $1,800 per share.”

3. China Mega Growth & EV Adoption

Lets start with the China catalyst, we believe that the Tesla China demand and production alone could be worth around $500 per share.

This is really important because China is the largest car market with 19 million cars sold per year, which is about 4 million more than the US. So the fact that Giga Shanghai continues to expand and increase production to meet the growing China demand is great news.

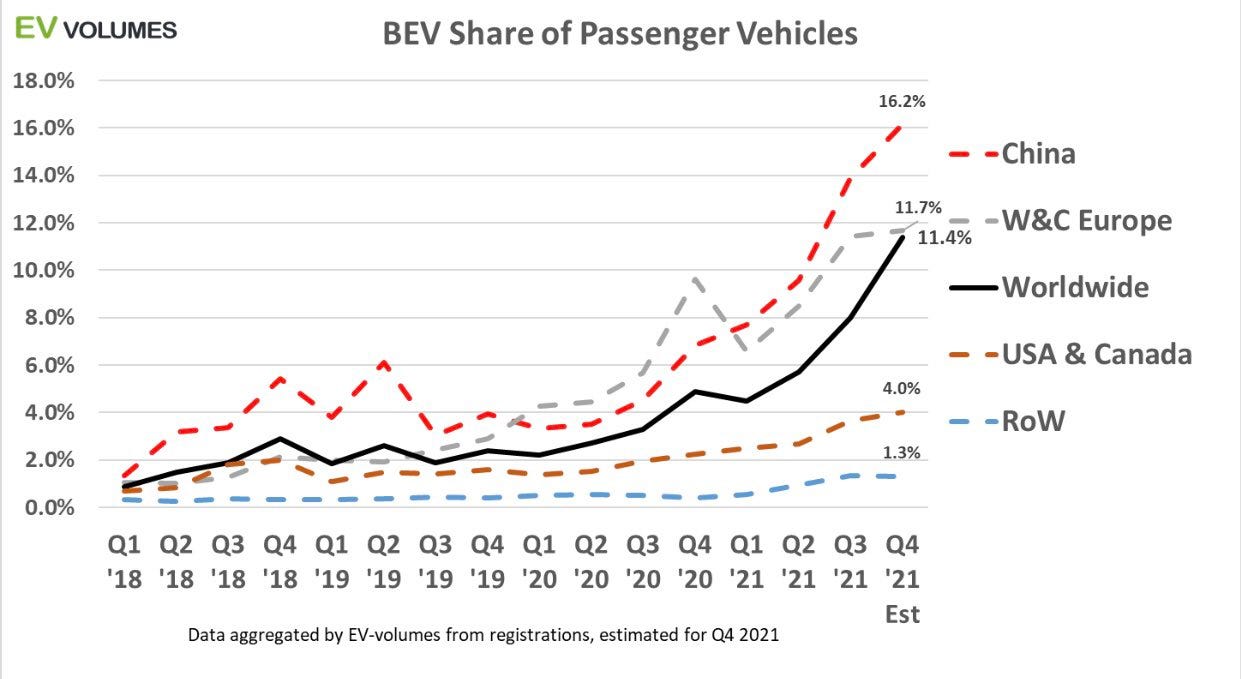

Secondly, the ever growing catalyst remind the growing EV adoption. It is following an exponential chart as you can see here, and this is going to continue to increase with more government subsidies and the growing charging infrastructure. Think about Tesla and its valuation now, and imagine when we reach BEV share of more than 50%. That is just something astonishing that will happen very soon!

So yes global BEV adoption is growing, but you’re asking what about Tesla specifically? Well Tesla will maintain its position as the leader in the electric vehicle market. Especially when at the end of next year the Cybertruck is launched, the Tesla Semi has entered early production and when in 2023 the $25,000 Tesla Compact releases. You best believe each one of those vehicles produced will be sold. So as you can see here in Norway, the demand for Tesla vehicles is just insane. This is Norway graph is what is about to happen to all of Europe when Giga Berlin opens up. You can see below here the graph regarding Norway registrations from 2020 compared to 2021..

Lets move on to one of the more important short term catalysts which is:

4. Elon stops selling & Window Dressing

So yes, even though Bloomberg and all these news articles are saying that Elon musk is still selling they are all wrong. Elon as stated in this form filed to the SEC by Tesla, i quote has ‘completed’ is stock selling. Similarly Elon musk can no longer sell any shares until after 4Q earnings due to the trading window. It is very strange that these big news outlets continue to imply that Elon has more stock he can sell but for now that is simply not true.

Gary Black articulated it very well yesterday when he said:

“Elon isn’t selling $TSLA shares today. TSLA’s trading window is now closed until after 4Q earnings in late-Jan. His 22.8M options are now fully exercised. Last night’s Form 4 footnote disclosed that his 10b5-1 trading plan “was completed” on 12/28. Someone else is selling.”

And finally, we have another short term catalyst namely, window dressing. Window dressing is what happens when hedge funds and other money managers buy the quarter, or year's best performing stocks for their positions to try and convince their clients that they are smart and that they own the best performing stocks. It doesn't actually change their performance but it improves the firms appearance. That is what is known as window dressing. This will happen with Tesla as Tesla is up 48%YTD compared to the S&P 500 being up only 29% year to date. Plus the fact that Tesla is about to smash earnings will make these money managers look very good if they own Tesla.

SO those are all the short term catalysts which could help Tesla stock grow massively by January, what do you think? Remember to share and subscribe and follow us on twitter at The Tesla Folder [Click]

Note, the video-essay version of this article is here: